Green shoots: clearer path ahead for future of sustainability reporting

Following months of turbulence for the EU’s Corporate Sustainability Reporting Directive, the year ahead promises welcome calm and clarity, writes Dee Moran

Two thousand twenty-five proved a turbulent year for the European Union’s Corporate Sustainability Reporting Directive (CSRD). At Chartered Accountants Ireland, our Professional Accountancy Team began the year preparing a series of webinars on the directive and putting the finishing touches to our guidance for members.

Everything shifted on 26 February, however. Just as first Wave One CSRD reporters (large public interest entities with more than 500 employees) were publishing their inaugural reports, the European Commission published its Omnibus package of simplification measures for sustainability reporting and regulation.

Effectively upending the European sustainability reporting landscape, the Omnibus package proposed a significant reduction in reporting and due diligence requirements under the CSRD, the Corporate Sustainability Due Diligence Directive (CSDDD) and the EU taxonomy for sustainable activities.

Key CSRD developments in 2025

The publication of the Omnibus package of simplification measures for sustainability reporting and regulation commenced the EU’s legislative process, sending the proposals to the European Council (the Council) and to the European Parliament (the Parliament) for negotiation.

The key CSRD developments that followed in 2025 are outlined here:

March 2025: Within the parliament, committees— primarily the Committee on Legal Affairs (JURI) and the Committee on Economic and Monetary Affairs (ECON)— began their technical assessment of the CSRD Omnibus proposals. Corporations and professional bodies intensified lobbying efforts, publishing position papers and advocating for their preferred outcomes.

April 2025: The “Stop the Clock” Directive was published in the Official Journal of the EU, formally delaying second and third wave reporting obligations by two years, and pushing out CSDDD obligations by 12 months. This provided immediate legal certainty for affected entities and allowed broader Omnibus negotiations to continue without the risk of unintended interim compliance. The reporting requirements for Wave One reporters remained unchanged.

June 2025: The Council adopted its general approach, confirming a negotiating position that supported:

- Raising thresholds to 1,000 employees and more than €450 million net turnover;

- Simplifying European Sustainability Reporting Standards (ESRS) requirements; and

- Removing sector-specific standards. This cleared the way for trilogue negotiations once the Parliament reached its own position.

July 2025: Ireland transposed the “Stop the Clock” Directive into Irish law on 7 July.

September 2025: Progress slowed over the summer as divisions within the Parliament emerged regarding the extent of the simplification. Disagreement on how far changes should go delayed the start of trilogue negotiations.

October 2025: On 22 October, the Parliament unexpectedly slowed down the trilogue mandate, creating uncertainty and forcing the Parliament to re-negotiate its position.

November 2025: A revised final position was adopted on 13 November, enabling trilogue negotiations with the Council and Commission to move ahead.

December 2025: On 9 December, the Council and Parliament negotiators reached a provisional political agreement on the Omnibus proposals. A week later, the Parliament formally approved the agreement, and the Council signalled its approval, closing out the political phase. The year ended with the conclusion of a prolonged and occasionally turbulent negotiation process.

At one point, thresholds under discussion suggested that only companies with more than 1,750 employees might remain in scope. Despite the twists and delays, however, achieving clarity by the year’s end was a welcome outcome for all stakeholders navigating the evolving CSRD landscape. excluding non-material disclosures.

The road ahead for the CSRD

The agreed changes to the CSRD are intended to ensure mandatory sustainability reporting is limited to the largest entities and groups, thus reducing the sustainability reporting burden for small and medium-sized enterprises (SMEs).

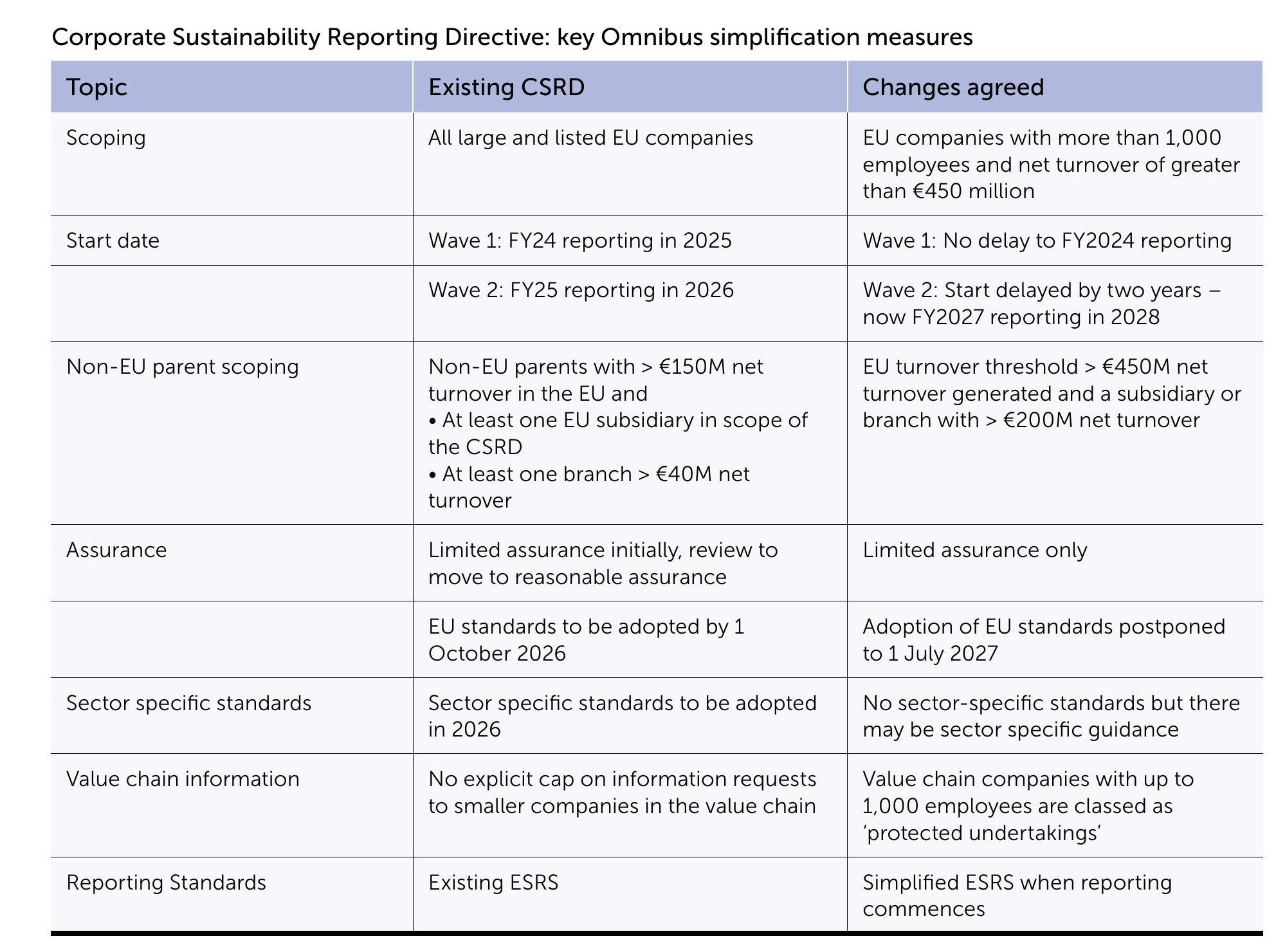

The main changes to the CSRD are outlined in our table below. However, several amendments merit further explanation here:

Scoping: The scope reduction is substantial. Instead of covering all large companies and all EU-listed entities, the CSRD will now apply only to EU undertakings with more than 1,000 employees and over €450 million in net turnover. In Ireland, the original estimate suggested about 1,500 companies would fall under the CSRD. The revised thresholds reduce this to roughly 150 companies, marking a dramatic narrowing of scope.

Non-EU parent companies: The thresholds for non-EU groups have increased significantly. A non-EU parent must now exceed €450 million in EU net turnover, and its EU subsidiary or branch must generate more than €200 million in turnover (up from €150 million and €40 million respectively). Given the high level of multinational investment into the EU, this change has notable implications.

Value chain: Updated value chain provisions limit the information that can be requested by companies within the revised scope of the CSRD, from companies in their value chain. This does not prevent companies from sharing more data if they wish, nor does it override legal or contractual commitments. It does, however, bring much needed clarity for SMEs on the type and volume of sustainability information they must prepare.

Assurance: Plans to transition from limited to reasonable assurance have been dropped. Only limited assurance will be mandated, a change welcomed by reporting entities. A decision on the adoption of an EU wide assurance standard has been deferred until 1 July 2027. In Ireland, the Irish Auditing and Accounting Supervisory Authority currently requires the use of ISAE 3000. This is not applied consistently across Europe, however, where many stakeholders favour the new international standard, ISSA 5000.

Reporting standards: Wave One reporters must continue to follow the existing ESRS requirements. While EU Member States may choose to exempt Wave One entities falling outside the revised scope, these entities must still comply with the current reporting rules until any such exemptions are formally transposed into national law. Wave Two reporters will adopt the simplified ESRS. The revised standards feature a 60 percent reduction in datapoints, with all voluntary datapoints removed, substantially lowering qualitative disclosure requirements and reducing the level of detail needed. The double materiality assessment (DMA) process has also been refined, providing clearer rules on Companies not in scope of the CSRD Given the revised CSRD thresholds, an estimated 98 percent of Irish companies now fall outside its scope.

Nonetheless, many of these entities will want to launch or strengthen their sustainability agenda—whether driven by investor expectations, supply chain demands, competitive pressures or simply a commitment to responsible business practices.

The Voluntary Sustainability Reporting Standard for SMEs (VSME) has been developed specifically to support companies that are out of scope.

Adopting this voluntary standard offers a structured, practical starting point for sustainability reporting. Because it is aligned with the CSRD, it also helps companies remain consistent with EU-wide supply chain expectations.

The VSME includes the following:

• A basic module with 11 disclosures and a Comprehensive module with an additional nine disclosures.

• Streamlined reporting on environmental, social and governance topics.

• No double materiality requirement, reducing complexity.

• A framework that acts as a limit on ESG data requests from larger companies.

• Digital reporting templates to simplify data collection and presentation.

The European Financial Reporting Advisory Group (EFRAG) has produced excellent guides and templates to assist VSME reporters.

EU sustainability reporting: next steps

We can expect to see several important developments in the evolution of the EU’s sustainability reporting regime in the months ahead, as follows:

The CSRD: With the Parliament and the Council having formally approved the CSRD amendments, the next step is publication in the EU’s Official Journal. The amendments will then take effect 20 days after publication, which is expected to be sometime in early 2026. Once published, EU Member States will have 12 months to transpose the changes into national law.

ESRS: EFRAG submitted its final technical advice and draft revised ESRS to the European Commission on 5 December 2025. The Commission will now review this advice as it prepares the delegated act needed to adopt the updated standards. Adoption is expected to follow promptly, likely within six months of the CSRD amendments entering into force. This timeline is important, as companies need clarity on the revised ESRS in time to apply them for 2027 reporting, and potentially on a voluntary basis from 2026. To support implementation, the interactive ESRS Knowledge Hub has been launched to help users navigate the standards.

VSME: The Commission issued a recommendation in July 2025, endorsing the VSME as the EU’s voluntary sustainability reporting standard for SMEs. The existing VSME was designed under the CSRD’s original scope, however, which applied to companies with more than 250 employees. It is not yet clear whether the Commission will mandate EFRAG to update the VSME, given that it will now serve as the voluntary reporting framework for the majority of companies (i.e. with up to 1,000 employees).

Substantial progress has been made in shaping Europe’s sustainability reporting framework, but much work remains to be done. Greater certainty should emerge in 2026 as the CSRD amendments are transposed, the revised ESRS are finalised and adopted, and a decision is reached on the future scope of the VSME.

Dee Moran, FCA, is Professional Accountancy Lead at Chartered Accountants Ireland