IFRS 18: a new era in financial reporting

IFRS 18 introduces a more unified and insightful approach to how companies present, disclose and communicate financial performance. David Drought and Naazneen Moosa delve into the details

The introduction of IFRS 18 Presentation and Disclosure in Financial Statements (IFRS 18) represents a significant evolution in financial reporting. This new standard has been developed in response to investor demand for clearer and more consistent information.

How groups present their financial performance can vary from one company to another. It is the International Accounting Standards Board’s (IASB) hope that IFRS 18 will provide investors with more transparent and comparable information about companies’ financial performance, thereby enabling better investment decisions.

The standard introduces a more unified and insightful approach to how companies present, disclose and communicate financial performance.

It encourages companies to review their systems, make informed judgements and prepare for a future in which financial statements will offer greater connectivity, more clarity across disclosures and enhanced comparability.

Why does IFRS 18 matter?

For years, there has been a lack of specific guidance on the structure of the income statement, leading to diverse presentations that have made it challenging to compare performance across businesses. IFRS 18 changes this by introducing a clearer, more consistent structure.

It replaces IAS 1 Presentation of Financial Statements (IAS 1) which has been in place since 1997 and, therefore, indicates that IFRS 18 is likely going to be here for some time.

The introduction of IFRS 18 does not represent a “quick fix” but rather a long-term shift that is likely to reshape financial reporting for years to come.

There is now an opportunity for groups to reconsider how they communicate to their investors and other key stakeholders in terms of the performance of their business.

Further, it is about telling the story of your business— what is management’s view of performance?—and providing clarity throughout the financial statements with the aim of building trust and enabling smarter decision-making.

Key IFRS 18 changes

IFRS 18 introduces three key changes:

1. A more structured income statement;

2. The disclosure of management performance measures

(MPMs); and

3. Enhanced guidance on aggregation and disaggregation of information.

1 Structured income statement

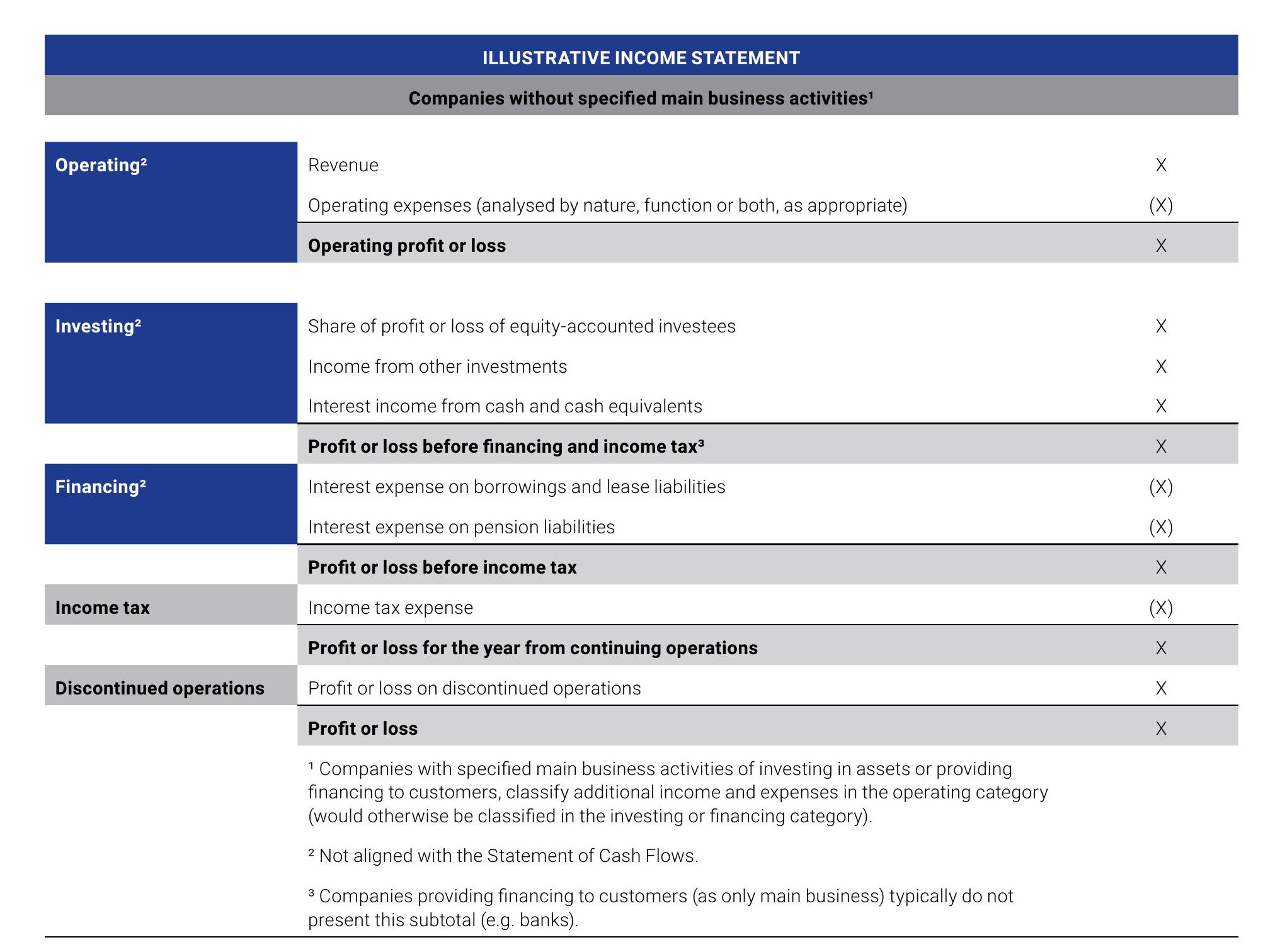

IFRS 18 mandates classification of income and expenses into three new categories—operating, investing and financing—in addition to the existing categories of income tax and discontinued operations. This structure enhances comparability across entities and industries.

Determining the appropriate classification depends on a company’s main business activities, which introduces a level of judgement, particularly for large and diversified groups.

For instance, a group that occasionally disposes of surplus equipment may treat the resulting gains as investing activities, whereas a company whose main business activity is refurbishing and reselling similar assets may classify them as operating.

In practice, such distinctions are rarely straightforward. Groups with multiple business lines may face challenges in identifying their main business activity, which in turn affects how items are classified across the income statement. This may impact a group reported operating profit, which is a key metric for many stakeholders.

These classifications can also have broader implications. For example, foreign exchange gains or losses may appear under different categories depending on the item which gave rise to such gains or losses.

Additionally, IFRS 18 requires two new subtotals and mandates that operating expenses be presented by nature and/or function on the face of the income statement, with additional disclosures (by nature) for those items presented by function (see graphic: Illustrative income statement).

2 MPMs

Management-defined performance measures (MPMs) are non-IFRS required subtotals of income and expenses used in public communications that reflect management’s view of performance of the company as a whole. Examples include EBITDA, adjusted EBITDA, adjusted profit and adjusted operating profit.

IFRS 18 requires a single note disclosure which reconciles the MPMs to IFRS-defined subtotals and includes disclosures pertaining to the calculation of such MPMs (including changes to the calculations and MPMs) and why it provides useful information. Accordingly, MPMs are now subject to audit as part of the financial statements.

In most cases, MPMs will fall within the broader category of alternative performance measures (APMs) but not all APMs will be considered as MPMs.

This provides an opportunity to reassess the existing suite of APMs, which may have expanded over time without strategic alignment. This reassessment may also prompt a broader review of performance metrics and disclosures.

Disclosing MPMs in financial statements that are subject to audit is a major shift, requiring companies to reassess their use of performance metrics and improve discipline and transparency.

3 Aggregation and disaggregation of information

Another major area of change under IFRS 18 is the enhanced guidance on disaggregation and aggregation of financial information.

This aspect is expected to bring substantial shifts in financial reporting practices, particularly for companies with complex operations, as it introduces new considerations around how financial information is grouped and presented.

This considers shared and non-shared characteristics such as nature, function, size, measurement basis, geography and regulatory environment, among others.

Further, labels like “other” are discouraged unless clearly explained.

This change aims to improve clarity and reduce ambiguity in financial reporting. It also introduces further judgement and complexity, however, especially in deciding what to present in the primary statements versus the notes to the financial statements.

Practical considerations and challenges

IFRS preparers have faced a number of new and complex standards over the years, but none with such a potentially wide-ranging impact on an organisation. As companies prepare for IFRS 18, we are seeing several practical implications arise, including:

1. Foreign exchange and derivatives: Classification across multiple categories may create mismatches within the income statement and requires detailed tracking.

2. Systems and data: Companies may need to update their chart of accounts, tools, systems and processes to capture new categories and disclosures.

3. Controls and processes: The integration of the IFRS 18 requirements may impact internal controls and audit procedures.

4. Peer and regulatory insights: Benchmarking and compliance will be critical as companies navigate the new financial reporting landscape.

Entities applying FRS 101 Reduced Disclosure Framework (FRS 101) and choosing to apply the Companies Act formats may not be significantly impacted.

Further, the Financial Reporting Council (FRC) has issued certain exemptions related to MPMs and the breakdown of operating expenses by nature, allowing continued use of existing formats for this purpose.

Preparing for IFRS 18

IFRS 18 applies to annual reporting periods beginning on or after 1 January 2027 with retrospective comparatives required and earlier application permitted.

This means companies will need comparatives for 2026—and possibly 2025 for SEC registrants. Accordingly, companies should begin preparing now to ensure a smooth and timely transition.

As part of the lead-up to IFRS 18’s effective date, companies should also consider the disclosure requirements in their FY25 and FY26 financial statements pertaining to the potential impact of new and upcoming standards.

The initial phases of this exercise will need to demonstrate that an assessment has been undertaken, and provide users with a meaningful update on the anticipated impact well ahead of adoption.

Preparing for IFRS 18 requires a proactive and coordinated approach. The volume and granularity of data required under IFRS 18, particularly for tracking items like foreign exchange across different balances, will likely stretch existing systems and processes. To navigate this transition effectively, companies should:

1. Form a cross-functional working group that includes finance, tax, IT and investor relations, ensuring all impacted teams are aligned from the outset.

2. Carry out a comprehensive impact assessment, considering implications for judgements, data architecture, internal controls and reporting processes.

3. Upgrade systems and tools to accommodate new classification and disclosure requirements, including the ability to capture and reconcile MPMs.

4. Engage stakeholders early, bringing them into the transition journey to foster collaboration and avoid bottlenecks.

5. Monitor developments in the reporting landscape to stay ahead of regulatory expectations and peer practices.

6. Begin tracking data for FY2026 comparatives, ensuring readiness for retrospective application.

While it may seem like we have plenty of time to prepare for the introduction of IFRS 18, now is the time to act and put a robust plan in place.

By taking early action, companies can position themselves to meet the new requirements with confidence and clarity. The journey to implementation may be complex, but it offers a valuable opportunity to enhance the quality and transparency of financial reporting.