Infrastructure deficit hurts Ireland’s competitiveness

Ireland’s competitiveness is slipping as infrastructure and energy challenges mount. Rob Costello and Sinead Lew examine the ramifications and urgent need for investment

Economic competitiveness drives productivity, innovation and investment, securing continued prosperity and raising living standards.

Competitiveness is especially important for small, open, export-led economies such as Ireland’s.

Our economy is among the most competitive in the world but recent analysis by the Institute for Management Development (IMD) indicates a relative decline.

Ranked the second most competitive economy in the world in 2023, Ireland fell to seventh in the rankings in 2025.

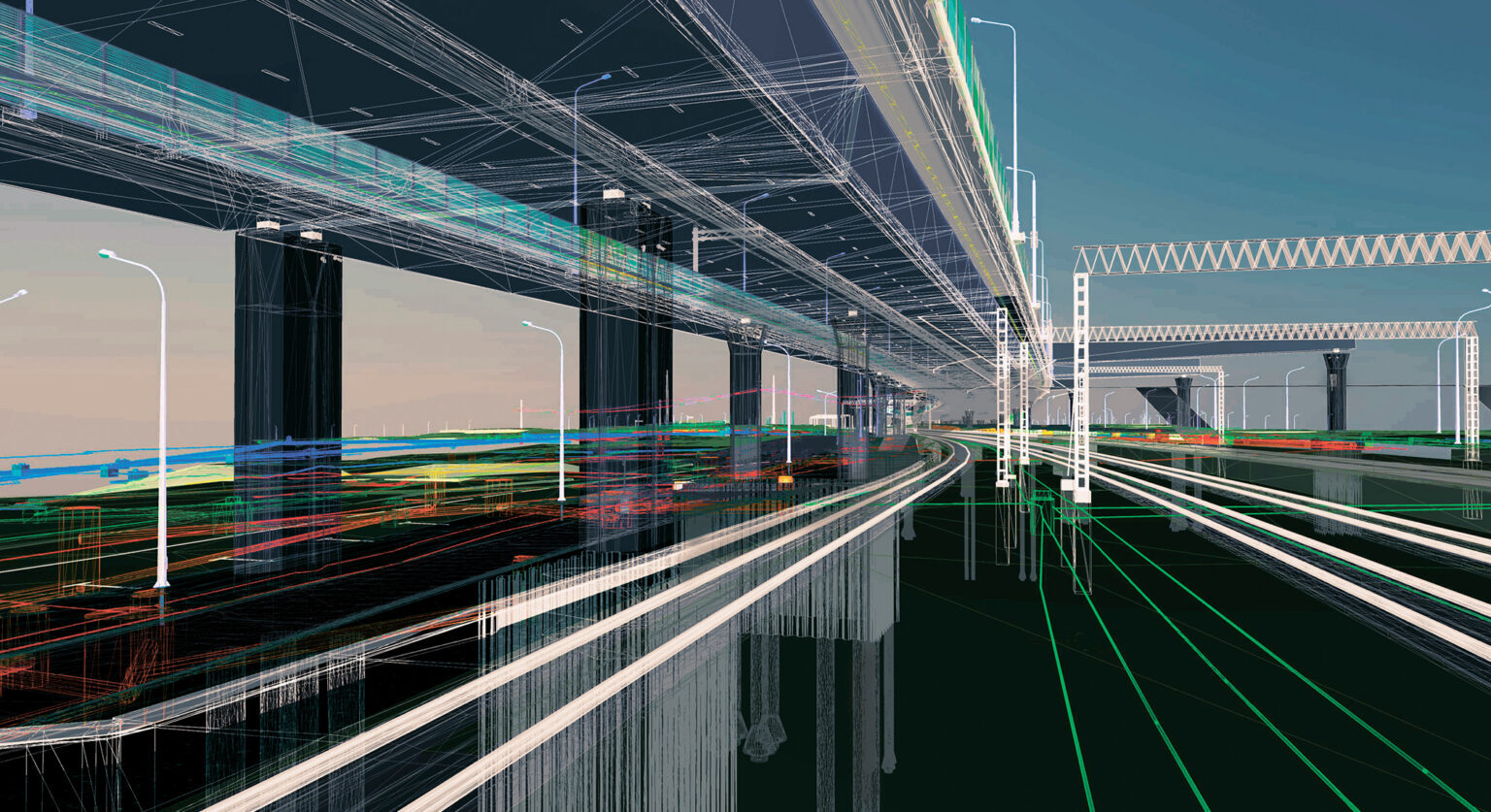

Infrastructure matters

The IMD assessment indicates that infrastructure quality and prices are the biggest factors affecting Ireland’s economic competitiveness.

Of the 69 countries surveyed, Ireland ranks 46th in terms of prices, while its basic infrastructure (e.g. transport, energy and water) ranks 44th globally—a six-place decline in one year.

This view is supported by analysis from the Irish Fiscal Advisory Council, which reveals Ireland’s infrastructure stock is 25 percent below the average among high-income countries.

Infrastructure quality is highly correlated with a country’s competitiveness and has a significant impact on prices, with the Central Bank of Ireland’s Deputy Governor recently noting that, in the absence of higher housing supply, house prices and rents will increase.

This will place upward pressure on wages and the cost of doing business, ultimately making Ireland’s exports more expensive in a global market.

In tackling our persistent infrastructure deficit, Ireland can drive down the cost of doing business while building on its existing strengths (e.g. institutions and an educated workforce), achieving greater competitiveness.

The price of power

As a high-tech, advanced, export-led economy, Ireland is highly dependent on our energy sector.

The reliable availability of clean and affordable energy underpins Ireland’s ability to compete on a global stage.

Despite this, it is becoming increasingly evident that Ireland’s investment in the energy sector is not keeping pace with demand.

This has left Ireland’s economy vulnerable to global events. For example, Russia’s invasion of Ukraine in 2022 led to a surge in natural gas prices.

With close to half of Ireland’s electricity produced with natural gas (almost all of which is imported), electricity bills ballooned, squeezing businesses and consumers and driving inflation across the wider economy. In 2024, Ireland’s electricity prices before taxes were the highest in the European Union (EU), 73 percent higher than the EU average.

Greater investment in a diversified set of energy sources—including wind, solar, biomethane and energy storage—will help reduce vulnerability to global shocks.

This will not necessarily drive energy costs down in the short- to medium-term, however, given the need to fund significant investment over the coming decades.

For example, capital-intensive renewable energy projects tend to have higher up-front costs and lower operational costs than traditional fossil-fuel-based systems.

The development of renewable energy sources also requires significant investment in electricity transmission and storage infrastructure.

With a sparse, widely dispersed population outside the Greater Dublin Area, developing Ireland’s energy infrastructure is more costly per person than in more densely populated countries, and this ultimately shows up in electricity costs.

While the upfront investment required for the energy transition will be costly in the short- to medium-term, it is worth noting that a failure to invest will likely leave Ireland’s energy costs among the highest in Europe.

At what cost?

The cost of failure to deliver critical infrastructure is not just the sunk cost (i.e. costs that have been incurred and cannot be recovered).

Delayed projects become more costly as prices increase. Delayed projects have opportunity costs, as they tie up resources, including labour, that could be deployed on other critical projects.

Projects that are delayed or stalled cost end-users through delays in access to the services infrastructure enables. Indeed, it is far from true to say that a project that doesn’t proceed is a cheap one.

Where there is a demonstrated need for a project, failed delivery has significant costs, both to society and the State, which is often required to address the need through other means. Failure comes at great cost to our climate, as targets are missed.

Ultimately, failure leads to a decline in competitiveness, lower productivity and weaker economic prospects for the country. Given these risks, Ireland can no longer afford to delay the delivery of critical infrastructure.

Rob Costello is Partner at PwC

Sinead Lew is Tax Partner at PwC