“There is an economic imperative to invest heavily in renewable energy, infrastructure and housing”

With the first half of an eventful year now behind us, Jim Power takes stock and asks, ‘what next for the Irish economy?’

So far, 2025 has turned out to be an extremely interesting, volatile and uncertain year.

The source of most of the uncertainty has emanated from US President Donald Trump, who continues to push a strong anti-free trade agenda, using tariffs as a weapon.

The tariff deal now agreed between Trump and European Commission President Ursula von der Leyen establishes a single, all-inclusive US tariff ceiling of 15 percent for European Union (EU) goods, effective from 7 August.

The 15 percent ceiling was thought to apply to most exports, including pharmaceuticals, but there is still considerable uncertainty on this point.

Despite the uncertainty and volatility that preceded the agreement of the EU-US deal on tariffs and trade on 27 July, the global economy has proved quite resilient so far this year—albeit growth everywhere is below trend and there is intense nervousness and uncertainty about the future.

The eurozone and UK economies are growing at a modest pace, while the US economy is still surprisingly on the upside. Inflation has come down to the two percent level central bankers typically target in most jurisdictions.

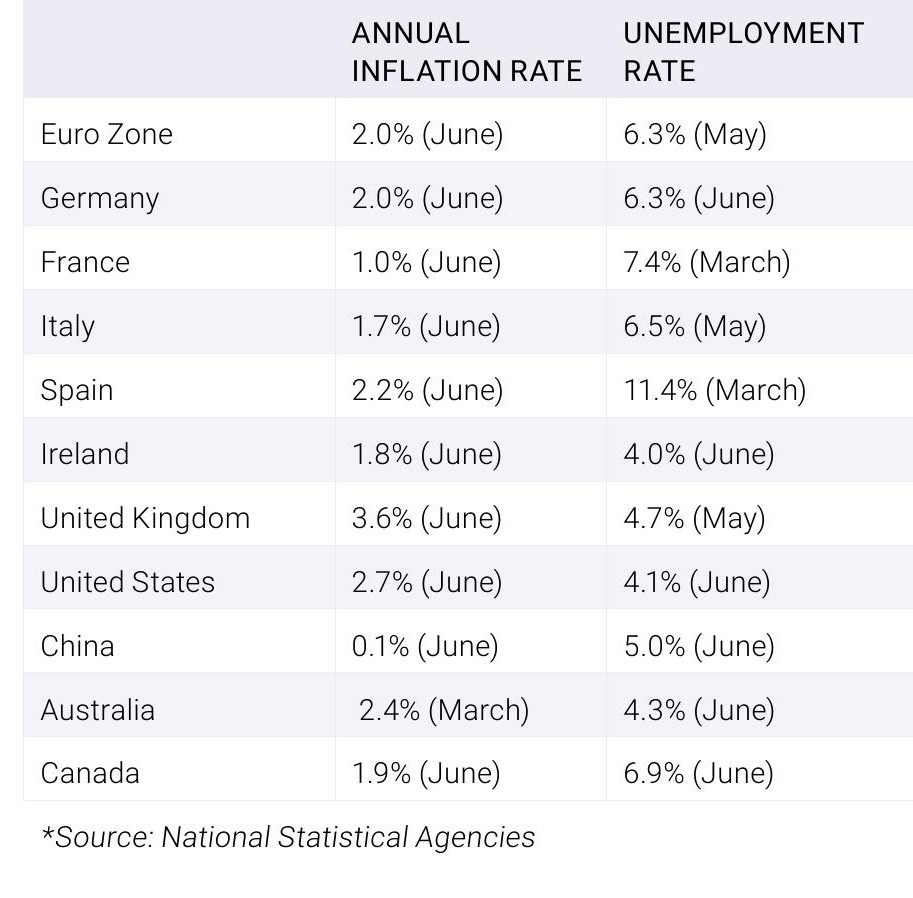

While inflation has fallen sharply over the past couple of years, labour markets have remained very tight, with close to full levels of employment in most countries (see Table 1).

Table 1: Global inflation and unemployment As inflation eased everywhere in 2024, central bankers started to ease monetary policy.

• The US Federal Reserve cut rates three times by a combined one percent between September and December 2024, taking the Federal Funds target range down to between 4.25 percent and 4.5 percent. Rates have remained on hold since the last cut in December.

• The European Central Bank (ECB) cut rates eight times by a total of two percent from June 2024 and 5 June 2025.

• The Bank of England cut rates four times between August 2024 and May 2025, taking the base rate down to 4.25 percent.

Looking ahead to the remainder of 2025 and into next year, many central bankers are facing a dilemma.

Economic growth is modest almost everywhere and the outlook is not clear, but there are concerns that tariffs will add to inflation.

However, the reality is that tariffs damage economic growth. The inflationary impact is likely to be offset by this negative impact on growth, and interest rates should fall gradually over the coming year. The ECB should cut rates by at least another 0.5 percent in the 12 months ahead.

Ireland: domestic outlook

Despite the intense international uncertainty, Ireland’s domestic economic backdrop has remained relatively strong.

Gross domestic product (GDP) grew by 7.4 percent during the first quarter, but the more representative measure of real economic activity—modified domestic demand (MDD) —expanded by two percent during the quarter and by 2.9 percent year-on-year.

This reveals an economy that is growing at a reasonable pace, although it must be recognised that growth in Ireland and elsewhere has been distorted by firms and consumers opting to front-load transactions in the run-up to the EU-US tariff deal.

External trade

In the first five months of 2025, merchandise exports were 46.9 percent ahead of the equivalent period in 2024.

Food exports were up 15.6 percent, while exports of chemicals and pharmaceuticals rose by 68 percent.

Exports to the EU rose 4.4 percent, exports to Britain were down by 12.2 percent and exports to the US rose 153 percent.

Chemical and pharmaceutical exports to the US grew by 188.7 percent. The trade data so far in 2025 are totally distorted by the front-loading of exports to the US ahead of the tariff deal, however.

Rate of inflation

Irish inflation peaked at 9.2 percent in October 2022 but subsequently moderated to 1.8 percent in June 2025. However, after an 18-month period of elevated inflation, the cost-of-living legacy is significant.

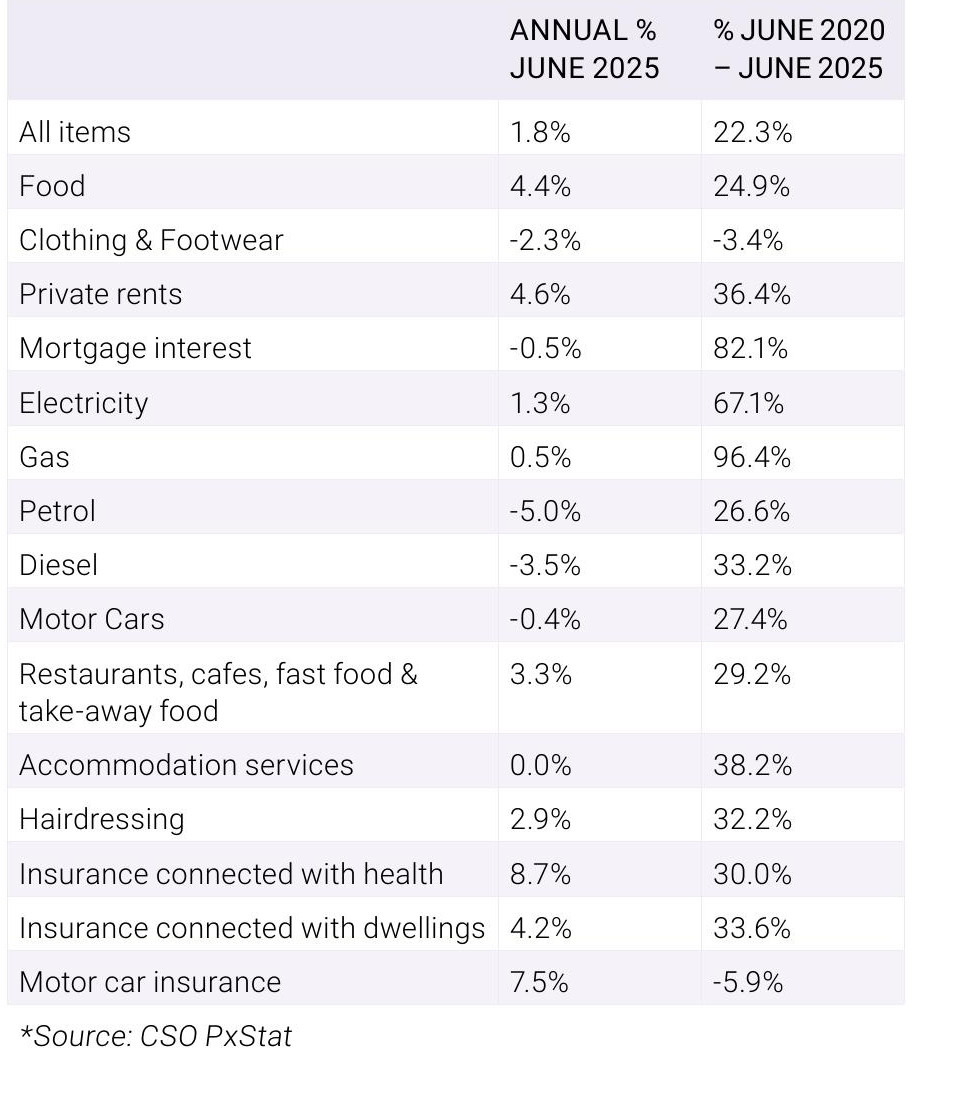

Table 2 shows that average consumer prices in June 2025 were 22.3 percent higher than five years earlier. The price of most items increased significantly over the period.

Consumer spending

In the first six months of the year, the volume of retail sales was just 1.4 percent higher than the same period in 2024.

New car sales were 3.5 percent up in the first half of the year. Consumer spending is still expanding, but greater

Table 2: Increase in selected consumer prices consumer caution is evident, not least due to the elevated cost of living.

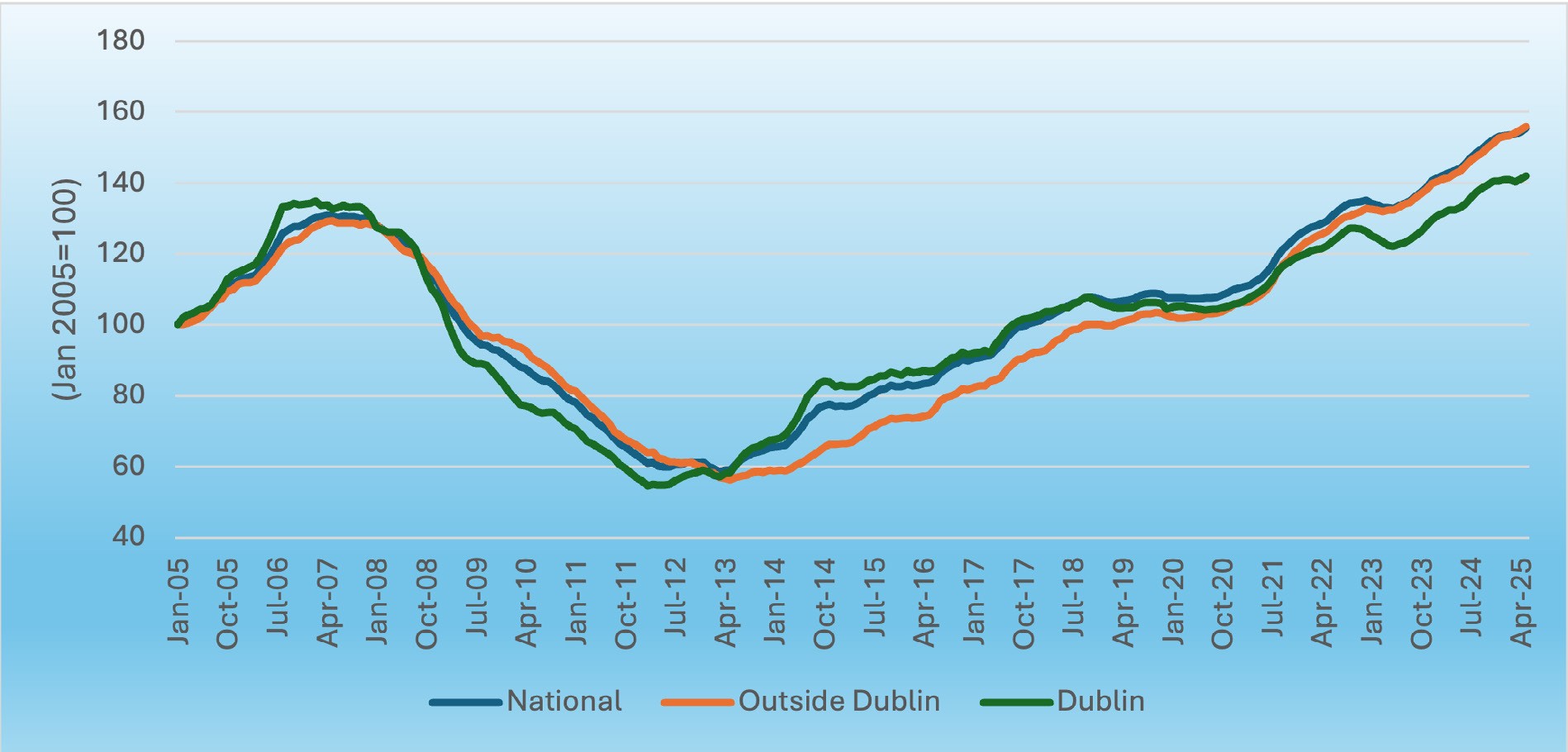

Figure 1: House price index

The housing market

So far in 2025, housing has remained the foremost topic of discussion in economic and political circles.

The Minister for Housing, Local Government and Heritage, James Browne, TD, is proposing measures to tackle Ireland’s housing crisis, including significant changes to rent pressure zones and building regulations for apartment development.

Meanwhile, house prices and rents continue on their inexorable upward trend, reflecting more than anything else, the massive ongoing gap between supply and demand in the market.

There was some moderation in house prices in the first quarter of 2025, but market momentum picked up again in May.

• National average residential property prices increased by 0.6 percent in May and the annual rate of increase rose to 7.9 percent, compared to 7.6 percent in April. Average residential property prices outside Dublin increased by 0.6 percent in May compared to the previous month, and by 8.7 percent on an annual basis.

• Average residential property prices in Dublin rose by 0.7 percent in May compared to the previous month and by 6.9 percent on an annual basis.

• The national residential property price index in May 2025 was 18.8 percent above its highest level at the peak of the property boom in April 2007. Dublin prices are 5.3 percent higher than their February 2007 peak, and prices outside Dublin are 20.5 percent above their May 2007 peak.

• Central Statistics Office data show that private rents increased by 4.6 percent in the year to June 2025. Between June 2012 and June 2025, average private rents rose by 125.6 percent.

Having an adequate supply of suitable residential accommodation to buy or to rent is the most crucial element of Ireland’s economic competitiveness. This is currently undermining national competitiveness as prices rise, pushing rents to highly elevated levels.

Exchequer returns

In the first half of the year, tax revenues amounted to €49.5 billion, up by €4.7 billion (10.5 percent) on the same period last year.

About one-third of this increase was due to one-off tax revenues arising from the Court of Justice of the European Union (CJEU) ruling of last September.

Excluding these windfalls, tax revenues in the first half of the year amounted to €47.7 billion, up €3.0 billion (6.7 percent) on last year.

The labour market

Despite intense global uncertainty, Ireland’s labour market performed well in the first half of 2025.

In the year to the first quarter, employment in the economy increased by 3.3 percent to 2.794 million—a record high. The unemployment rate stood at four percent in June, which is very close to full employment.

What lies ahead

In summary, the Irish economy has performed quite well so far in 2025. There are clear risks, however.

Ireland has an inordinate dependence on US multinationals for both direct and indirect employment—and, more worryingly, income tax and corporation tax receipts.

• In 2024, Chemical and Related Products accounted for 65.2 percent of Irish merchandise exports, with 40 percent of the total exported to the US.

• At the end of 2024, 302,566 workers were employed by companies supported by IDA Ireland. It is estimated that a further 272,000 workers are indirectly dependent on IDA-supported companies.

• In 2024, corporation tax accounted for 36.2 percent of tax receipts in Ireland—the highest level ever recorded.

• The multinational sector pays about 85 percent of corporation tax. Ten multinational companies accounted for 52 percent and three for 40 percent. The workers in those 10 companies accounted for 10 percent of income tax.

• The top 20 percent of income taxpayers accounted for 80 percent of income tax paid. Many of those higher paid workers tend to work in the multinational sector.

It remains to be seen what more the Trump administration might do to further the ‘America First’ agenda, but his strategy highlights just how vulnerable Ireland’s multinational sector—and, hence, the overall economy—is to changes to the US corporation tax code and tariff policies.

The risks to Ireland are very real. There is an absolute economic imperative to invest heavily in renewable energy, the electricity grid, water infrastructure and housing.

In the meantime, it is likely that new inward foreign direct investment flows will cool in a changed global environment. It is essential that we counteract risks associated with Ireland’s over-dependence on multinationals by actively nurturing indigenous SMEs.

The Government has just committed to capital investment of €112 billion between 2026 and 2023 in housing, water, energy and transport—this is essential.

In broad terms, the outlook for the Irish economy is still positive, but in an environment of such intense uncertainty, slower growth looks inevitable. All eyes will remain on Trump, whose tariff policies represent an existential threat to Ireland.

Jim Power is a self-employed economist and co-host of ‘The Other Hand’ podcast. This article is based on data and information available up to 1 August 2025